Rail shipping across North America is a multi-billion dollar annual business that spans more than 46,000 kilometers of track in Canada alone. It’s still too early to say what kind of year it’s going to be for rail traffic in 2016—January saw a slight uptick in the total number of continental carloads and intermodal units after a dismal December 2015 —but trend lines for specific commodities are clear, especially when we compare carloads between 2013 and 2015.

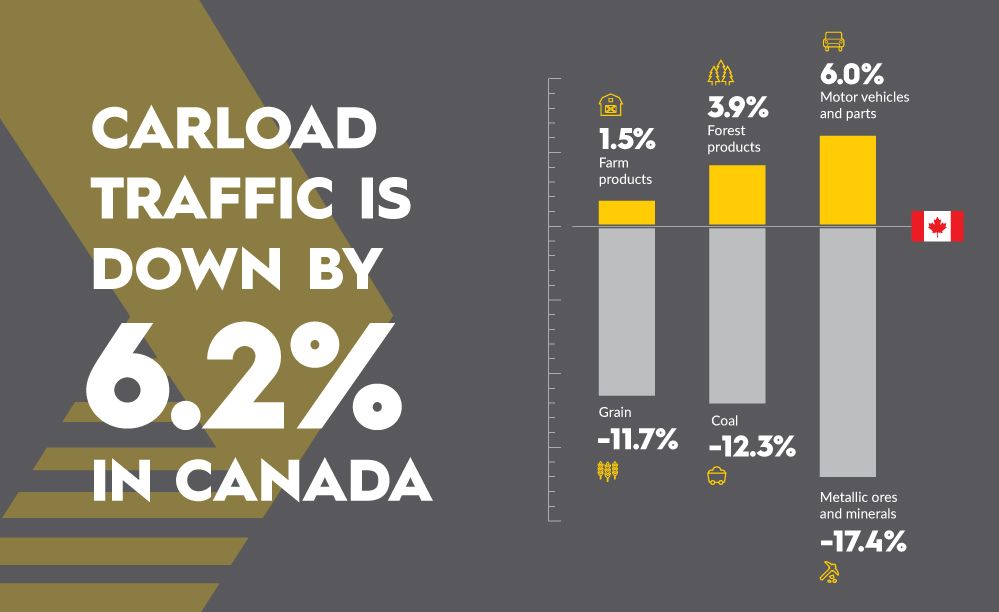

Canada

According to the Association of American Railroads, shipments of coal, non-metallic minerals, metallic ores and metals dragged down total carloads in Canada last year. Here’s a snapshot of Canadian leaders and laggards.

The sharp drop in coal, non-metallic minerals, metallic ores and metals signified a particularly tough year for the Canadian mining industry. But increasing shipments of forest products and motor vehicles and parts might be further boosted by Canada’s adoption of the Trans-Pacific Partnership (TPP), which will reduce trade barriers on these and other products.

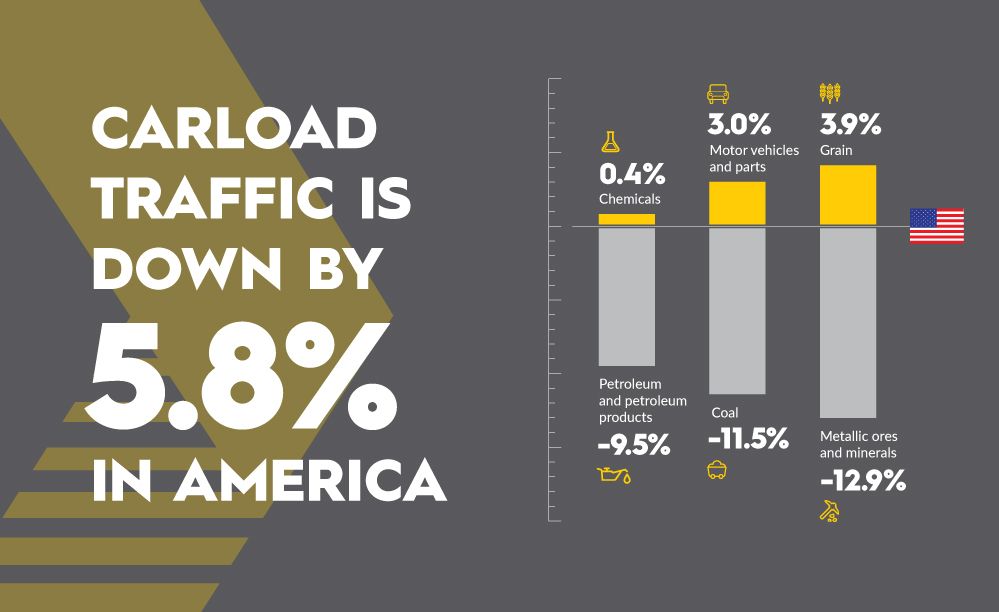

The U.S.

Although total U.S. rail shipping loads are five times bigger than Canada’s, both economies are so tightly interconnected that Canadian rail shipping was almost a mirror of U.S. activity throughout 2015, but with signifcant exceptions.

In the U.S., a significant decrease in mining materials led to a sharp overall drop in total carloads. But, unlike Canada, a further drop in petroleum shipments combined with modest growth in total shipments resulted in a worse year for the U.S. than Canada overall.

How accurate will 2013-2015 trends be at predicting future growth?

Weekly rail traffic data between 2013-2015 suggests the so-called “freight recession” is indeed upon us: the combination of low gas prices, weak commodity prices and a high dollar is creating a “perfect storm” that will increase pressure on shippers and potentially continue to drive carload volumes down even further by the end of 2016.

But gains in intermodal unit shipping in the U.S. and Canada, and strong volume performers in each country—grain and motor vehicles in the U.S.; forest products and motor vehicles in Canada—may yet nudge carloads upwards as consumers regain confidence.

We’ll be watching the trend lines closely.